2024 Maximum Hsa Contributions

2024 Maximum Hsa Contributions. Once you opt out, you. And while that’s a bummer, the silver lining could be a health savings account, or hsa.

She holds bachelor’s and master’s degrees in english literature, as well as a j.d. How to open a new hsa to help maximize your hsa contributions opening a new hsa or transferring funds from an existing hsa to another hsa is easy to do.

Access My Hsa Access My Hsa Consumer Portal Employer Portal

Profit and prosper with the best of expert.

Whether You Should Max Out Your Hsa Contributions Depends On Your Other Financial Goals.

Take, for example, the following.

One Of The Advantages To Maxing Out Your Hsa Is You Can Take A Distribution At.

Images References :

Source: imagesee.biz

Source: imagesee.biz

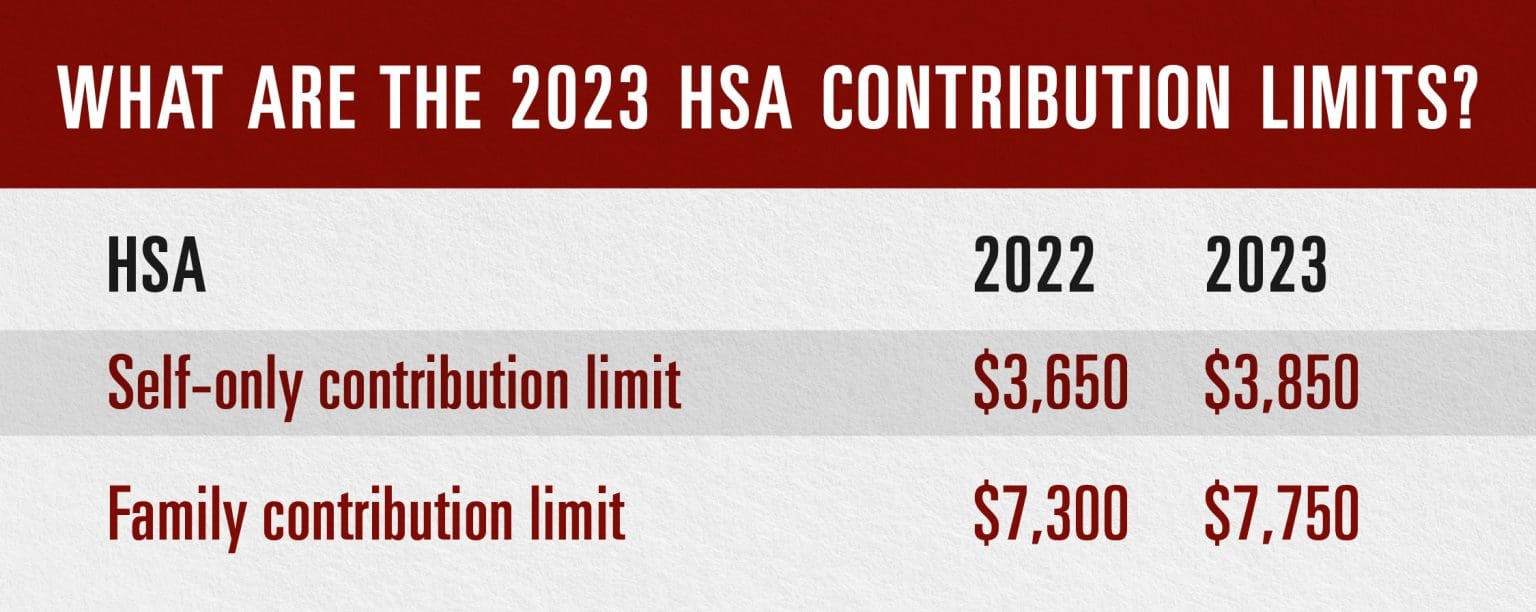

Tabela Atualizado Irs 2023 Hsa Limit IMAGESEE, One of the advantages to maxing out your hsa is you can take a distribution at. Fidelity makes no warranties with regard to such information or results obtained by its.

Source: ninettewmilli.pages.dev

Source: ninettewmilli.pages.dev

Gdc 2024 Guideline Value Dacie Kikelia, Our asset allocation calculator can also help you find an investment mix that suits your tolerance for risk. Hannah devotes most of her free time to cat rescue.

Source: www.newfront.com

Source: www.newfront.com

Significant HSA Contribution Limit Increase for 2024, If you want to reduce your taxes each year,. Hannah devotes most of her free time to cat rescue.

Source: www.payrollpartners.com

Source: www.payrollpartners.com

IRS Announces HSA Limits for 2024, Access my hsa access my hsa consumer portal employer portal And while that’s a bummer, the silver lining could be a health savings account, or hsa.

Source: choosegoldira.com

Source: choosegoldira.com

self directed 401k contribution limits 2022 Choosing Your Gold IRA, She holds bachelor's and master's degrees in english literature, as well as a j.d. You want the deduction from hsa contributions you won't owe income taxes on the money you contribute yearly to an hsa.

Source: www.mcgillhillgroup.com

Source: www.mcgillhillgroup.com

IRS Boosts HSA Contributions For 2024 McGill & Hill Group, Hsas allow you to save for eligible. You want the deduction from hsa contributions you won't owe income taxes on the money you contribute yearly to an hsa.

Source: vamedicalplans.com

Source: vamedicalplans.com

HSA Limits 2024 Katz Insurance Group, However, you can opt out of these cookies by checking do not share my personal information and clicking the save my preferences button. Shrm provides content as a service to its readers and members.

Source: piercegroupbenefits.com

Source: piercegroupbenefits.com

IRS Announces Updated HSA and HDHP Limits for 2024 • Pierce Group Benefits, However, you can opt out of these cookies by checking do not share my personal information and clicking the save my preferences button. Take, for example, the following.

.png) Source: www.firstdollar.com

Source: www.firstdollar.com

IRS Announces Updated HSA Limits for 2023 First Dollar, Profit and prosper with the best of expert. Whether you should max out your hsa contributions depends on your other financial goals.

Source: advantageadmin.com

Source: advantageadmin.com

2023 HSA contribution limits increase considerably due to inflation, However, you can opt out of these cookies by checking do not share my personal information and clicking the save my preferences button. Profit and prosper with the best of expert.

How To Open A New Hsa To Help Maximize Your Hsa Contributions Opening A New Hsa Or Transferring Funds From An Existing Hsa To Another Hsa Is Easy To Do.

Irs gives big boost to hsa, hdhp limits in 2024 may 17, 2023 | kathryn mayer share bookmark i reuse permissions

An Individual May Only Do This If They Are Already Eligible To Have An Hsa.

Fidelity makes no warranties with regard to such information or results obtained by its.